The programme for future leaders in corporate finance and investment management.

The Master’s Programme in Corporate Finance blends the latest Russian and international practices in teaching finance and developing leadership skills with advanced technologies in education.

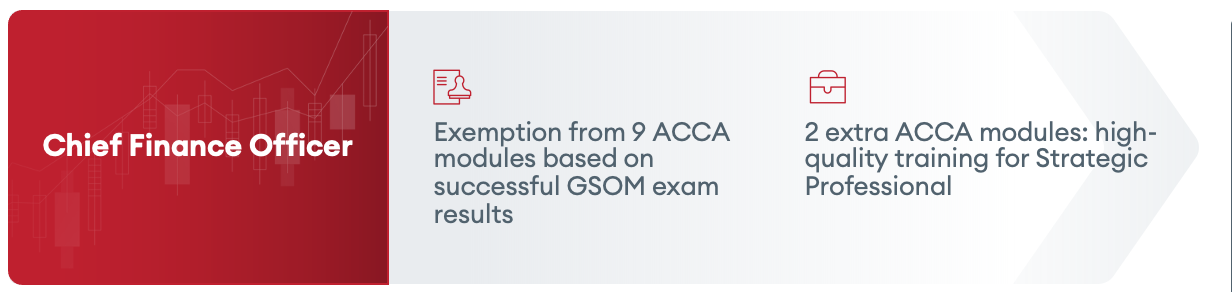

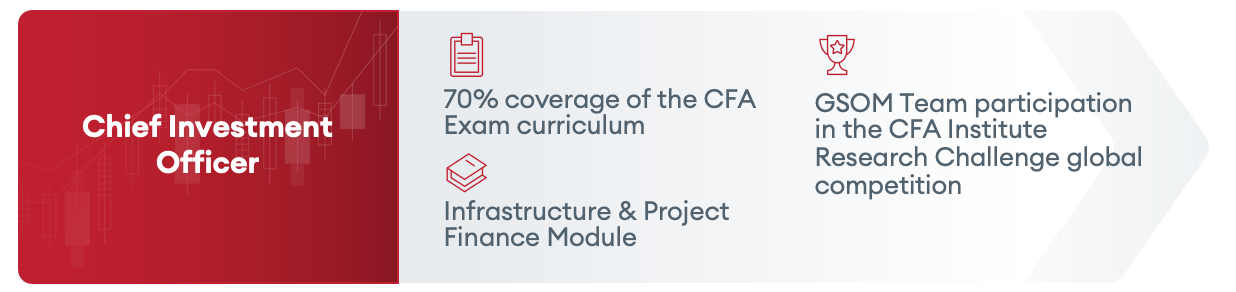

The programme is delivered by expert investment banking practitioners, chief financial officers and top consulting industry professionals who are eager to share their valuable knowledge and expertise within finance. Graduates are able to pursue a brilliant career as a chief financial officer or a chief investment officer across the globe.

The main goal of the programme is to train future leaders in corporate finance and investment management who are equipped with the know-how to use analytical tools, have strong financial and investment analyst skills and excel in dealing with a range of business tasks in the finance industry.

The programme is designed for future professionals working

in sectors such as:

MCF graduates will be able to:

MCF graduates will be trained to:

Students participate in international conferences such as International Conference on Game Theory and Management, the Annual Pashkus Readings, Public-Private Partnership in Transport Sector: models and experience. Besides, GSOM Team takes part in the CFA Institute Research Challenge global competition.

The programme runs in close collaboration with finance and investment departments of GSOM corporate patrons, including VTB Bank and VTB Capital, PwC, Gazprom, Gazprom Neft.

Every year top Russian and international companies offer MCF students industry-based internship placements. Among them are financial institutions (VTB Bank, Raiffeisen Bank) and manufacturing and IT companies (Siemens, WRIKE, Gazprom Export/Sales and others).

PROGRAMME CURRICULUM

Is a set of subjects and modules which ensure that graduates build a brilliant career as a Chief Finance Officer or a Chief Investment Officer in any company.

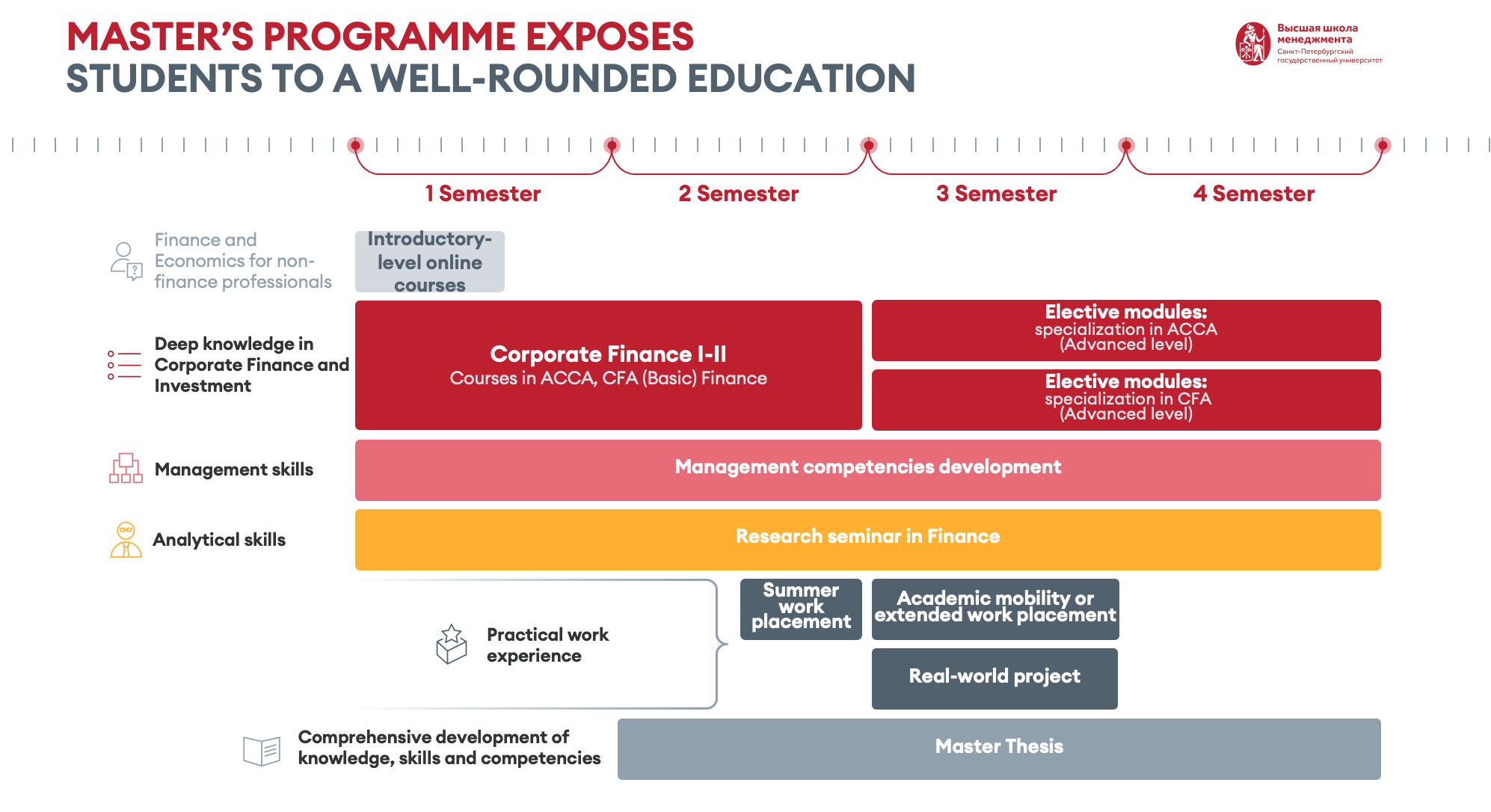

Comprehensive training for a young professional.

|

|

Introductory-level online course for a good start |

Finance and Economics for non-finance professionals |

|

|

|

|

| Chief Financial Officer | ||

|

|

Successful training leads to exemption from ACCA’s examinations Modules are run in line with ACCA standards |

Corporate Finance Financial Reporting and Accounting Performance Management and Decision-Making Taxation in Russia Corporate Law in Russia Audit and Assurance Advanced Corporate Finance Advanced Performance Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Director | |

|

|

In line with the corresponding CFA topics |

Alternative Investments and Portfolio Management |

|

Fixed Income and Derivatives |

||

| Economics for Investors | ||

|

Quantitative Methods in Finance |

||

|

|

|

Economics for Investors |

|

|

|

|

|

|

Management Competencies Development |

Cross-curriculum course in Leadership Development |

|

|

|

|

|

|

Hands-on experience |

Summer work placement in top companies |

|

|

|

|

|

|

Crossing Borders |

A semester abroad |

|

|

|

|

While passing 6 specialised exams successfully MCF students receive exemptions from 6 ACCA exams respectively and may move on to take 4 final professional exams. So, since the GSOM-developed curriculum covers 70% of ACCA exams, students reap the benefit by being provided with an accelerated route (up to 1 year, instead of 3 years) to ACCA membership.

If students pass two out of six accredited exams both in GSOM and in ACCA, they may gain an Oxford Brookes University bachelor's degree (ranked #33 in Great Britain in the Guardian Ranking 2020),

При использовании данного сайта Вы подтверждаете свое согласие на использование ВШМ СПбГУ cookie файлов. С подробной информацией Вы можете ознакомиться, перейдя по ссылке.